Embrace Pet Insurance Plans Vs. Spot Pet Insurance Plans Comparison

Loving pet owners know there are a lot of different pet insurance providers out there that offer plans with different levels of coverage. Looking for the right pet insurance option for your fur babies can seem overwhelming. If you’re deciding between Embrace Pet Insurance plans and Spot plans, you’re probably wondering what the difference is. At Spot, we don’t shy away from comparison because we are confident in the product we offer! Here, we take a look at what you get with a Spot Pet Insurance plan vs. an Embrace Pet Insurance plan.

See How Spot Plans Stack Up

At Spot, we're all about what goes into your coverage options. We think we provide some best-in-showplans.

It’s part of our commitment to be there for your pets and make it easier to be the best pet parent you can be. Want to learn more about what makes us stand out? How do these policies differ, and what does each pet insurance plan cover?

Here are some of the ways Embrace Pet Insurance plans differ from Spot plans:

Embrace plans require additional fees to get coverage for microchipping and Rx supplements for covered conditions.

Embrace plans’ multi-pet discount of maybe 5 percent, depending on the state.

Embrace accident & illness plans to limit new enrollments to pets under 15 years old. If your pet is older than that, Embrace will not allow you to enroll for accident & illness coverage, and you can only enroll in an accident-only plan.

Embrace plans have a six-month waiting period for orthopedic conditions unless customers complete an exam and waiver process.

Behavioral Issues

No Upper Age Limit

Exam Fees

Preventive Care

Microchip

Prescription Foods

Alternative Therapies

Chronic Conditions

One Annual Deductible

Specialists

Hereditary & Congenital Conditions

Dental Illness

Multi Pet Discount

30-Day Money Back Guarantee

Comparison information is provided using publicly available information as of 3/2/24 and is only meant to summarize program features, not a specific plan. Review each provider’s plan terms for more details. The descriptions of other providers’ plans were not provided by that company. If you have questions about other plans, please contact an agent of that company. It is our intention to provide fair and accurate comparison information. Although we attempt to keep information up to date, it may change from time to time. If you are aware of any inaccuracies or changes in the information provided, let us know by emailing marketing@spotpet.com.

5 Reasons to Consider Spot plans

1. Embrace plans microchip coverage is an extra cost

Microchipping is an important measure that helps pet parents protect their pets from being lost. If your dog or cat gets lost, a microchip gives them the best chance of finding their way back home to you. Microchipping may cost between $30 and $50, and pricing varies by location.

Spot plans include coverage for microchip implantation in all core plans. This extra measure can help provide you with valuable peace of mind, so we’re happy to offer plans with this coverage to pet parents.

To be reimbursed for microchip implantation with an Embrace pet insurance policy, you need to add on their Wellness Rewards, which is an additional cost on top of your base plan premium.

2. Embrace accident & illness plans have an upper age limit for new enrollments

At Spot Pet Insurance, we passionately believe that all pets should have access to exceptional coverage regardless of their old age.

Embrace plans will not enroll new dogs or cats 15 years old or above in accident & illness plans. They can only enroll in an accident-only plan.

Spot plans have no upper age limits for new enrollments. Once your pet is eight weeks old, you’re welcome to enroll in Spot plan. Getting your pet covered sooner will help ensure that you have the support you need early on in their life.

3. Embrace plan coverage for Rx supplements used to treat covered conditions is an additional cost to the base plan.

To be eligible for coverage of Rx supplements for covered conditions with an Embrace policy, you need to purchase their Wellness Rewards.

However, Spot takes a holistic approach to pet care. Spot plans cover Rx supplements that are prescribed to treat covered conditions. Spot Pet Insurance plans to make it simple to get help with providing your pet with the supplements they need to treat covered conditions.

4. Embrace plans’ multi-pet discount maybe 5%, depending on the state.

Why should you pay more for pet health insurance if you have multiple pets? We believe all of your pets should have access to coverage — and that you should be rewarded for your loyalty.

Embrace offers a multi-pet discount, but it may be 5 percent off depending on the state you live in. Spot plans’ multi-pet discount is 10 percent off added policies in all 50 states — customer care that cares.

5. Embrace plans have a six-month waiting period for orthopedic conditions

While Spot plans and Embrace plans share the same 14-day waiting period for illness coverage, Embrace doesn't extend this to orthopedic conditions (which include hip dysplasia, ligament tears, intervertebral disc disease, arthritis, and bone fractures).

To have the six-month waiting period for orthopedic conditions reduced, Embrace policyholders need to have an orthopedic exam performed by their vet. Embrace plans do not cover the check-up exam unless the customer has added Embrace Wellness Rewards to their policy.

With plans provided by Spot, eligible orthopedic conditions are given the same 14-day waiting period.

The Spot treatment

At Spot, we believe in making pet parenting as easy as possible — while providing your pet with what they need to thrive. We help pet parents support their cats and dogs by offering preventive care coverage at an additional cost (for things like wellness exams, spay/neuter, and diagnostic testing).

You can play all day with your pets with less worry. You love your routine with your pets, and Spot supports that routine.

Tucker's Road to Recovery

When emotional support dog Tucker experienced a life-threatening injury to his neck, he needed extensive treatment. His pet parent Kim was able to choose the treatment option that would provide Tucker with the best quality of life because of the financial support provided by Tucker's Spot plan.

Cost of Treatment: $4,305

Spot Plan Reimbursed: $3,874.505

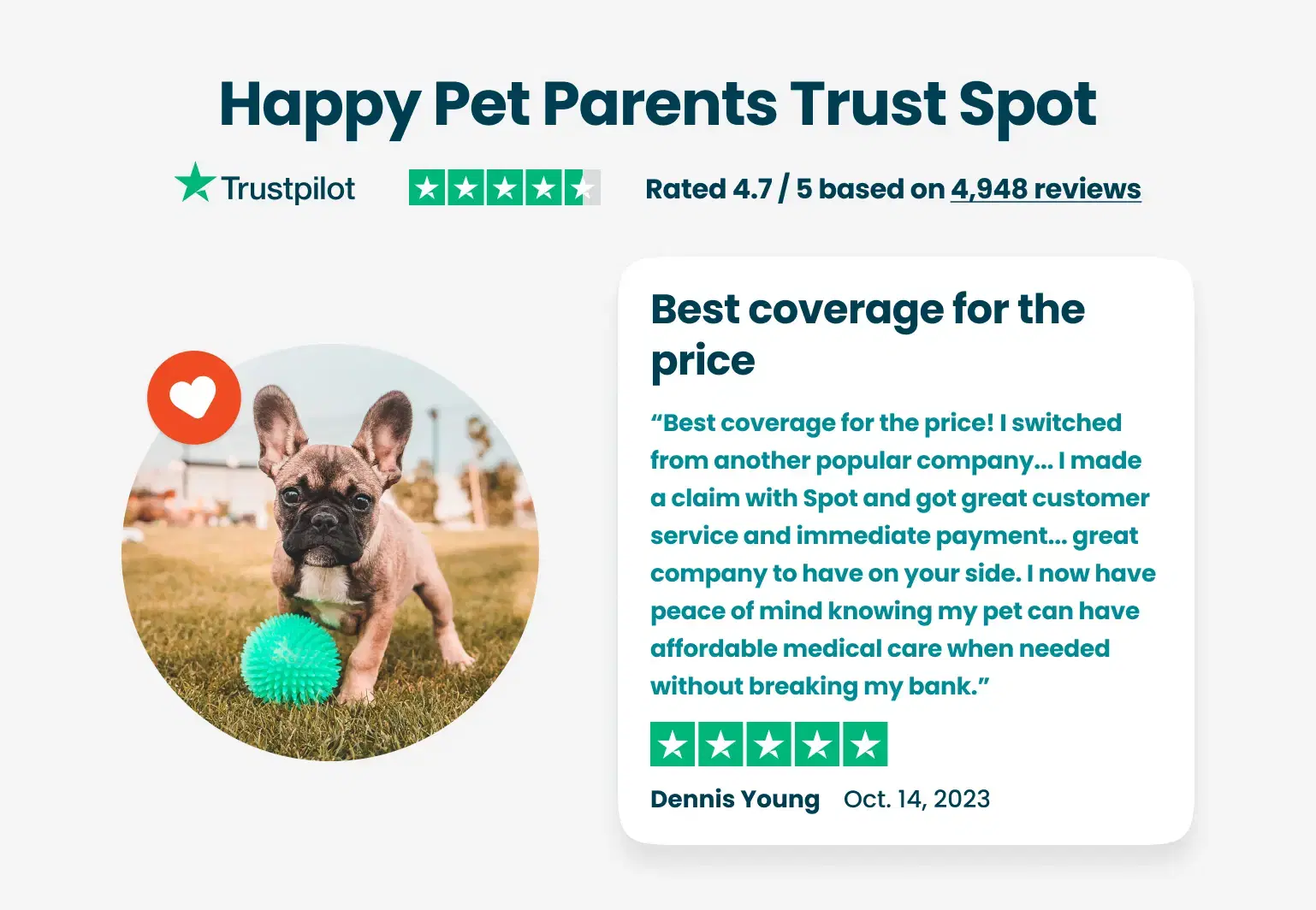

Happy Pet Parents Trust Spot

Great return for the cost

Great return for the cost! Easy to use claim process!

Good communication

Good communication, quickly claims processing.

Easy filling and quick refunds

Easy filling and quick refunds

Handled our claim in a prompt…

Handled our claim in a prompt professional manner.

Got Spot for my Doggie 4 years ago at…

Got Spot for my Doggie 4 years ago at the ripe age of 3 months. 3 weeks ago she tore her ACL and had surgery. Made a claim at Spot and the claim was handled and processed in record time and received my reimbursement just yesterday. Unbelievable

Quick and easy

Quick and easy. Helps offset the vet bills never had any issues.

Great rates

Great rates. Super quick claims service. Buy it!

Very quick claim response

Very quick claim response. Professional service.Glad we chose spot for our pups insurance!

communications was excellent

communications was excellent

Quick response time

They are quick to respond& seem to really care about what is happening