Figo Pet Insurance Plans Vs Spot Pet Insurance Plans Comparison

We know that your pet is a member of your family — full stop. The humans in your family have insurance coverage, but what about your pets? Pet insurance is often viewed as a complicated and confusing topic. We’re here to change that. At Spot, we think we have incredible service and product offerings. However, we want you to decide for yourself. We are going to do an analysis on some top pet insurance providers, including ourselves. Today we’re going to go over Figo vs. Spot. We're stacking the plans we offer up against some top competitors’ plans. Take a look below and see how Spot plans differ from Figo plans.

See how Spot plans stack up

Some people say comparison is the thief of joy. At Spot, we're happy to compare ourselves to others. We're confident in the products we offer.

Spot plans provide your pet with extensive plan options.

Here, we take a look at a few key differentiators between pet insurance plans offered by Spot and Figo:

As a policyholder of a plan from Figo, you need to pay an additional fee to get coverage for exam fees for eligible conditions. This is not the case with Spot plans.

Figo plans do not cover microchipping.

Figo has a separate cap on how much they will reimburse for behavioral problems. If eligible treatment for your pet’s behavioral problem costs more than this cap, you’ll have to pay for those yourself.

The breakdown below gives a look at some of the core features for each providers’ plans.

Behavioral Issues

No Upper Age Limit

Exam Fees

Preventive Care

Microchip

Prescription Foods

Alternative Therapies

Chronic Conditions

One Annual Deductible

Specialists

Hereditary & Congenital Conditions

Dental Illness

Multi Pet Discount

30-Day Money Back Guarantee

Comparison information is provided using publicly available information as of 3/2/24 and is only meant to summarize program features, not a specific plan. Review each provider’s plan terms for more details. The descriptions of other providers’ plans were not provided by that company. If you have questions about other plans, please contact an agent of that company. It is our intention to provide fair and accurate comparison information. Although we attempt to keep information up to date, it may change from time to time. If you are aware of any inaccuracies or changes in the information provided, let us know by emailing marketing@spotpet.com.

Some Key Differences

1. Spot Plan Coverage includes Exam Fees for Covered Conditions.

Figo plans require an additional cost to cover Exam Fees for covered conditions.

With Spot plans, your Accident-Only or Accident & Illness plan will cover exam fees for covered conditions. If your pet is undergoing cancer treatment, or treatment for a covered condition, the exams are eligible for reimbursement if they are not otherwise excluded.

We know how stressful exams and hospitalization for accidents and illnesses can be. We want to help make it easy for loving pet parents to get their animals the care they deserve.

In comparison, Figo plans coverage does not extend to exam fees for covered conditions unless policyholders add Veterinary Exam Fees coverage to their plan, which costs extra.

2. All Spot plans cover microchipping. Figo plans do not.

Microchip implantation is a quick, and simple procedure that can help pet parents reunite with lost pets. All Spot policies cover microchip implantation; Figo policies do not.

At Spot, we want to help provide you with the resources you need to be the best pet parent you can be — and help ensure your best chances of reuniting with your furry friend if they get lost.

3. Spot plans do not have a separate annual limit for behavioral problems. Figo plans have a separate annual limit for behavioral problems.

Spot plans cover behavioral problems, and they don’t have a separate annual limit specific to behavioral problems.

Figo plans also cover behavioral problems. However, they have a separate annual limit of $500-$1000 for behavioral problem coverage.

4. Spot Plans Cover the Cost of Prescription Foods

Spot plans cover the cost of prescription foods as long as it is prescribed by a licensed vet to treat a covered condition. Figo plans do not include coverage for prescription foods that your vet may prescribe your pet.

Planning for the future

We hope this answers some of your questions regarding the difference between Spot plans and Figo pet insurance plans.

Whether you have a cat or dog, rest assured that Spot Pet Insurance wants to help you give your pet the care they require.

Tucker's Road to Recovery

When emotional support dog Tucker experienced a life-threatening injury to his neck, he needed extensive treatment. His pet parent Kim was able to choose the treatment option that would provide Tucker with the best quality of life because of the financial support provided by Tucker's Spot plan.

Cost of Treatment: $4,305

Spot Plan Reimbursed: $3,874.505

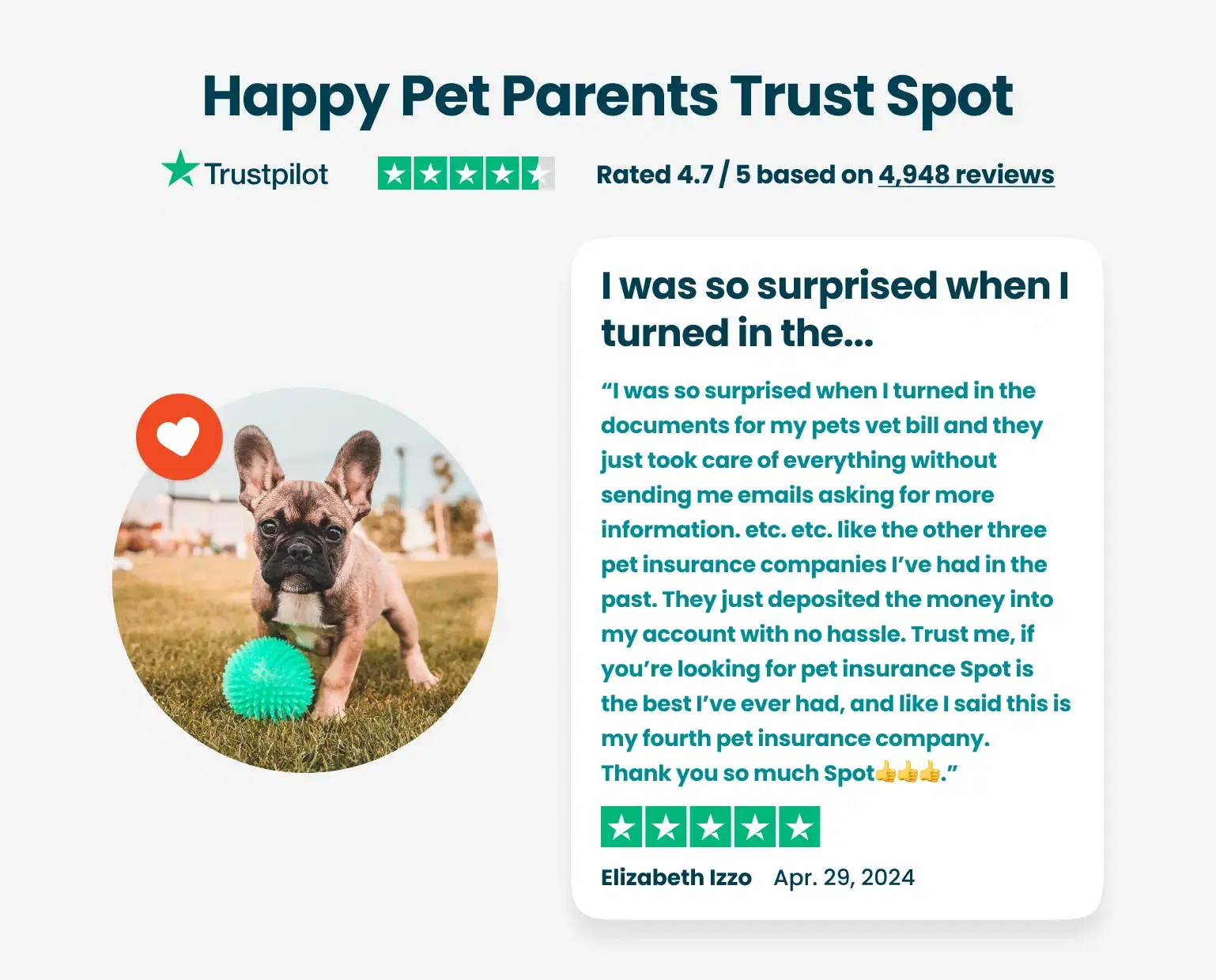

Happy Pet Parents Trust Spot

Our First Claim…Easy and quick!

Our dog developed severe dental disease requiring numerous extractions and bone loss from an abscessed tooth. I was very happy about how easy it was to send in the bill from the vet and payment was issued in less than a week. Spot processed the claim in a fair manner and we did not have any difficulties. This was our first claim in almost three years of coverage so I wasn’t sure what to expect but am happy to say Spot provided the coverage we paid for and makes it very easy to submit your claim! Highly recommend them.

Efficient

The process was quite simple and non-bureaucratic. The claims were processed quickly, statuses were communicated, and there was no back-and-forth with disputes, needs for endless documentation and verification, or any other red tape.

Efficient on time claim resolution

Efficient on time claim resolution

How fast you were to process my claims

How fast you were to process my claims

Easy payment reimbursement

Easy to navigate claims

Quick

Quick, no questions asked/no hassle reimbursements. For sure helps with an already stressful situation. I’ll recommend them to anyone

Spot was there when it mattered most.

In one of the most difficult times in my life as a dog mom, Spot seemlessly managed the bills I submitted. I didn't need to jump through hoops as I have with other insurance companies. Instead, I was able to simply submit my bills and the payment came quickly and without issues. It made an extremely difficult time, less stressful knowing Spot was there to help.

You have been fair and upfront with…

You have been fair and upfront with payments. Thank you, I feel that I have chosen the right pet insurance

Such Great company and Insurance for…

Such Great company and Insurance for our doggy Rocky paid great for his Knee surgery after his injury:)

Everyone at Spot has been so helpful…

Everyone at Spot has been so helpful and understanding! I love this company and have never had any issues .