Progressive Pet Insurance Plans Vs. Spot Pet Insurance Plans Comparison

Do you want to learn more about the differences between Progressive Pet Insurance plans and Spot plans? Pet insurance can help when our pets get sick or injured. It reimburses policyholders for eligible vet bills. There are several illnesses like cataracts, skin infections, hip dysplasia, elbow dysplasia, GDV, cherry-eye, IBD, etc. which can affect our pets. We might be able to control where our pets go and what they do most of the time, but we can’t control how and when these illnesses will affect our pets. This is when accident & illness pet insurance helps on a rainy day.

Buying some types of auto insurance is the law in most states. However, pet insurance is elective, so many don’t think about it until their pet needs pricy emergency care. But which kind of pet insurance coverage do you need? What does pet insurance cost?

We will be on that helpline; let’s chat about pet insurance policies.

Selecting the right pet insurance coverage for your pet is anything but easy, which is why we will help simplify some info about offerings for pet health insurance. If you have Progressive Insurance, you might be wondering, does progressive offer pet insurance? And if so, is a Progressive Pet Insurance plan my only plan option?

If you’d like to learn more about the pet insurance plans that Progressive offers compared to Spot Pet Insurance plans, you are in the right place.

Behavioral Issues

No Upper Age Limit

Exam Fees

Preventive Care

Microchip

Prescription Foods

Alternative Therapies

Chronic Conditions

One Annual Deductible

Specialists

Hereditary & Congenital Conditions

Dental Illness

Multi Pet Discount

30-Day Money Back Guarantee

Comparison information is provided using publicly available information as of 3/2/24 and is only meant to summarize program features, not a specific plan. Review each provider’s plan terms for more details. The descriptions of other providers’ plans were not provided by that company. If you have questions about other plans, please contact an agent of that company. It is our intention to provide fair and accurate comparison information. Although we attempt to keep information up to date, it may change from time to time. If you are aware of any inaccuracies or changes in the information provided, let us know by emailing marketing@spotpet.com.

Comparing Pet Insurance Plans

We’re happy to compare our pet insurance offerings to another competitor because we are confident in the plans we offer.

Here are some of the differences between Progressive Pet Insurance plans and Spot Pet Insurance plans.

Spot Pet Insurance plans will cover supplements that your vet prescribes to treat covered conditions. Progressive Pet Insurance plans will not.

Spot Pet plans offer a 10 percent multi-pet discount for all additional pets. Progressive plans’ discount is 5 percent.

With Progressive Pet Insurance plans, you have to opt into exam coverage for covered conditions. Coverage for exam fees for covered conditions is included in Spot plans; no additional add-on fee is required.

Are you stressing about vet visits and the subsequent vet bills? Do you want to learn more about what differentiates Spot’s cat and dog insurance plan options from Progressive’s options?

Continue reading about the differences.

1. Spot Pet Insurance plans cover supplements that are prescribed to treat covered conditions.

Progressive Pet Insurance plans do not.

2. If you have multiple pets, Spot Pet Insurance offers a 10 percent multi-pet discount for all additional pets.

Are you the proud pet parent of multiple dogs or cats? If so, Spot Pet Insurance plans will give you a 10 percent multi-pet discount for all additional pets after the first. With Progressive Pet Insurance plans, you’ll get a 5 percent multi-pet discount.

3. Spot Pet Insurance plans cover exam fees for covered conditions; no additional add-on fee is required.

When you bring your pets in for an exam for an eligible accident or illness, you’ll have that covered by Spot Pet Insurance plan. With a pet insurance plan from Progressive, you will need to add the coverage to your base plan for an additional fee if you want it.

Peace of mind

With premium-quality pet insurance plans like Spot Pet Insurance plans, you can have help minimizing the financial risks involved with the unpredictability of being a pet owner.

Tucker's Road to Recovery

When emotional support dog Tucker experienced a life-threatening injury to his neck, he needed extensive treatment. His pet parent Kim was able to choose the treatment option that would provide Tucker with the best quality of life because of the financial support provided by Tucker's Spot plan.

Cost of Treatment: $4,305

Spot Plan Reimbursed: $3,874.505

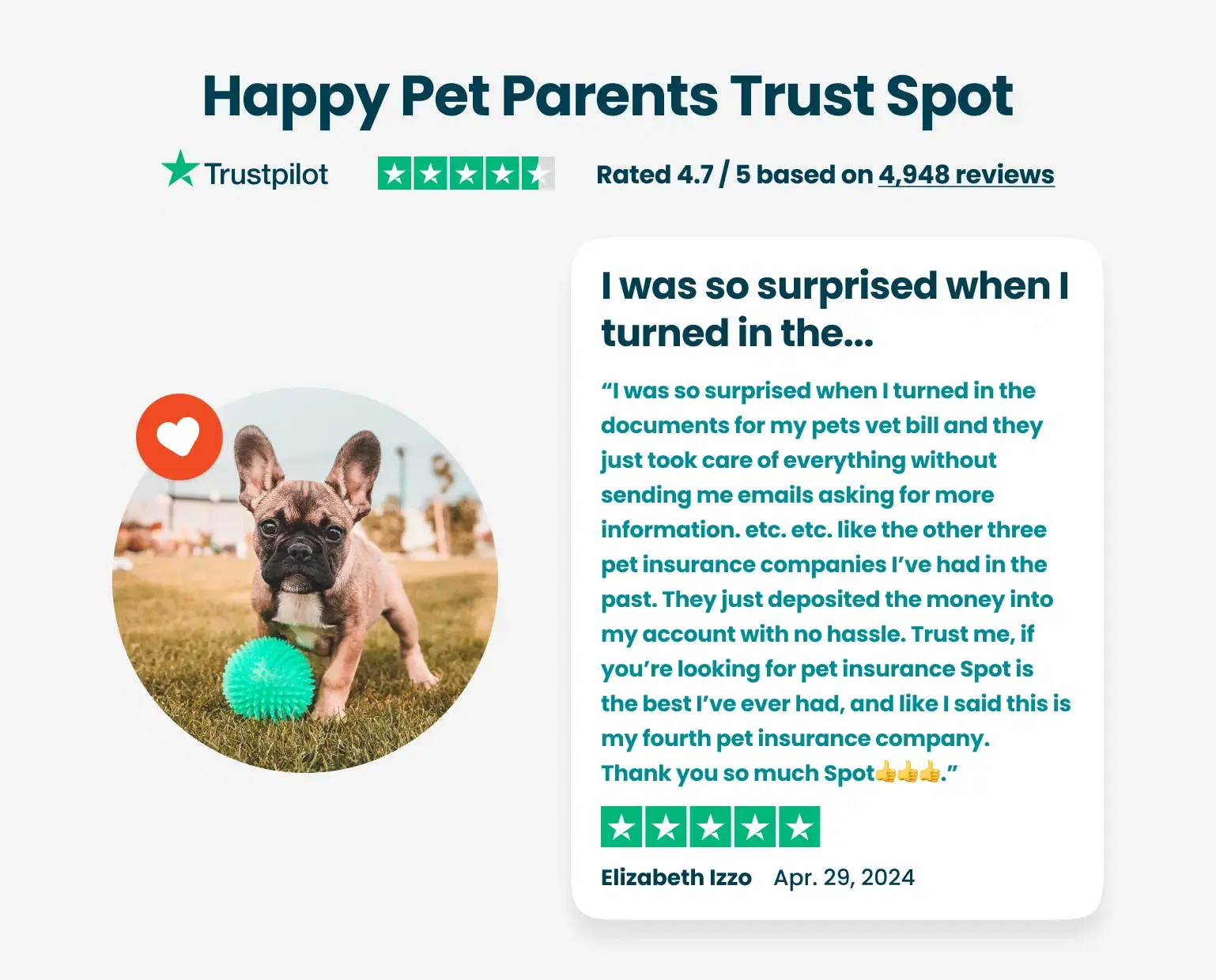

Happy Pet Parents Trust Spot

Easy peezy

Quick and easy to submit claim. Review and reimbursement was fast. Very satisfied.

I had 2 claims to put in for my dogs…

I had 2 claims to put in for my dogs TPLO surgery and they were extremely fast and efficient in getting my claims completed and funds reimbursed.

So glad to have Spot!!

So glad to have Spot! It’s affordable and they take care of claims quickly and efficiently - I didn’t have to keep calling to check the status of my claim. My pup had surgery 2 weeks ago and the claim was paid before the 10 day follow up visit. It’s been a relief, thank you Spot!!!

I have had Spot insurance for probably…

I have had Spot insurance for probably almost 2 years! My cat Meeko needed surgery to remove bladder stones that could not be treated with medication! Filing a claim was easy and the response was swift.

Quick turn around

Quick turn around

Great pet insurance !

We have enjoyed working with Spot Insurance. They make the application process easy to apply and understand. They quickly assess claims and refund their percentage of reimbursement. We have been very pleased!

Great service and professionalism

Great service and professionalism. I submitted my cat Orbit's bill from the emergency vet office and they processed it quickly. I did not expect this to happen to my cat and the expense was a surprise but having this insurance has been such a blessing.

Claim was handled quickly and…

Claim was handled quickly and efficiently.

Spot has been a huge money saver for…

Spot has been a huge money saver for us, our cat recently had a UTI and was diagnosed with asthma. The process of uploading the bill was as easy as uploading a picture. The App makes it easy even for an old person like me. Spot contacted our Vet and got the background information they needed on our cat and quickly issued us the reimbursements. I recommend Spot for any pet owner who wants to have the confidence of being able to take your pet to the vet when needed without worries of not being able to pay the rent that month.

Great platform and very responsive

Great platform and very responsive. Claims are reviewed and paid in an expedited manner.