Fetch Pet Insurance Plans Vs. Spot Pet Insurance Plans Comparison

In the world of pet insurance providers, we're all working toward healthier pets. With so many different options, it can be time consuming and tricky to find the right one. It gets even more confusing when your pet is dealing with specific conditions like hip dysplasia. When it comes to pet health, we feel like Spot plans really hit the "Spot." You might have some questions about pet insurance policies. Comparing Spot plans to other plans you might be considering, such as Fetch Pet Insurance plans, can help you see differences. Here’s what you need to know about how Spot plans differ from Fetch plans.

How do Spot plans and Fetch policies differ?

There are some key differences between Spot plans and Fetch plans. Here are a few that you might want to know about:

Fetch plans don't cover microchip implantation in their base accident and illness plans.

Fetch plans don't offer a multi-pet discount

Fetch policyholders must have their pet examined within 30 days of policy start (if they haven't been to the vet six months prior to the policy start date).

Behavioral Issues

No Upper Age Limit

Exam Fees

Preventive Care

Microchip

Prescription Foods

Alternative Therapies

Chronic Conditions

One Annual Deductible

Specialists

Hereditary & Congenital Conditions

Dental Illness

Multi Pet Discount

30-Day Money Back Guarantee

Comparison information is provided using publicly available information as of 3/2/24 and is only meant to summarize program features, not a specific plan. Review each provider’s plan terms for more details. The descriptions of other providers’ plans were not provided by that company. If you have questions about other plans, please contact an agent of that company. It is our intention to provide fair and accurate comparison information. Although we attempt to keep information up to date, it may change from time to time. If you are aware of any inaccuracies or changes in the information provided, let us know by emailing marketing@spotpet.com.

4 Reasons to consider Spot plans over Fetch plans

1. Fetch plans don't cover microchip implantation.

Microchip implantation is quick and simple and can help increase the chance that a pet parent and lost pet will be reunited by 80%. All base plans provided by Spot cover microchip implantation.

Fetch plans do not cover microchip implantation in their base plans. For an extra cost, Fetch offers coverage for microchip implantation in their Wellness add-ons.

2. Fetch plans don't offer a multi-pet discount.

We know that many pet lovers can't have just one fur baby! Spot plans provide a 10 percent multi-pet discount for all added pets after the first. With Fetch plans, any added pets will have a full-priced premium insurance plan.

3. Fetch plans do not cover prescription food.

Spot plans cover prescription foods and supplements as long as they are prescribed by a licensed veterinarian.

Fetch plans do not cover any prescription foods.

4. Fetch plans may require an exam within 30 days of the policy start date.

Fetch requires new policyholders to take pets for an annual check-up and dental cleaning within six months of the policy start date to be eligible for coverage.

Spot plans do not have preventive care requirements for coverage eligibility.

Find the pet insurance that’s right for you

We trust that you know your pet best and will bring them in to see the vet when you know they need assistance. That’s why Spot plans don’t just cover exam fees for eligible conditions, but also alternative therapies, like acupuncture, that are prescribed to treat eligible conditions.

Tucker's Road to Recovery

When emotional support dog Tucker experienced a life-threatening injury to his neck, he needed extensive treatment. His pet parent Kim was able to choose the treatment option that would provide Tucker with the best quality of life because of the financial support provided by Tucker's Spot plan.

Cost of Treatment: $4,305

Spot Plan Reimbursed: $3,874.505

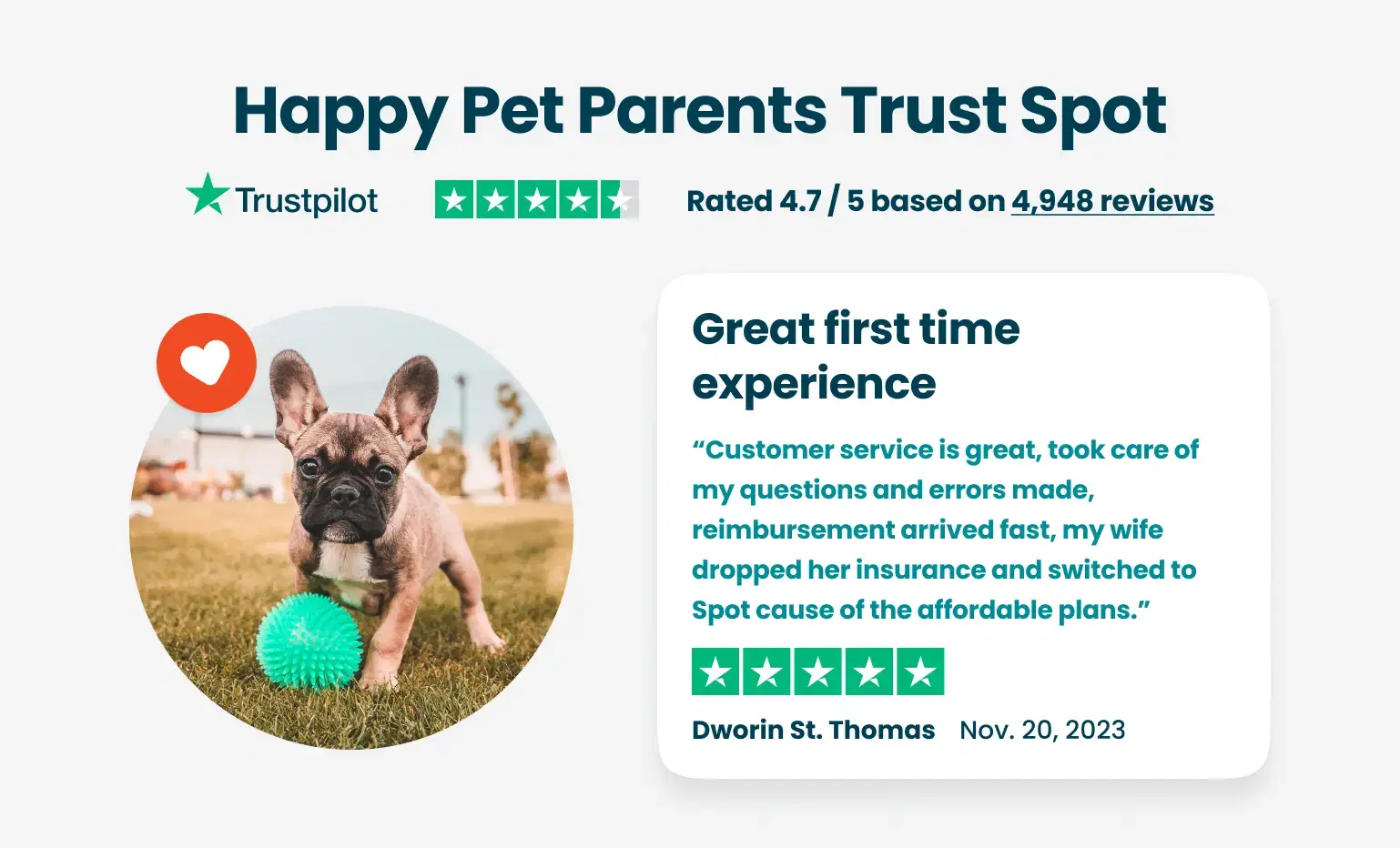

Happy Pet Parents Trust Spot

It's always so easy to submit claims.

It's always so easy to submit claims.

Pet owner's best friend

Really excellent insurance, which we carry on both dogs. In a perfect world, our dogs would be healthy forever and incur minimal vet bills, but the reality is, illness and injury happens, and bills can be exorbitant. Well worth the monthly charge. The website is easy to navigate, and customer service is quick and responsive.

Ellie review …

the person on the phone was very pleasant and nice to speak to

Love!

The response time and customer service are amazing.

We had the best insurance with Spot

We had the best insurance with Spot. If we come back from abroad we’ll renew with Spot for sure. Customer service TOP kind and knowledgeable

Fast and efficient processing of my…

Fast and efficient processing of my claim - Truly appreciated.

super easy process to submit/upload…

super easy process to submit/upload claims docs.

Effortless Pet Insurance

Effortless

Company that’s actually a pleasure to do business with…

Spot is a great company to deal with regarding my pets care. No one wants to have to take their pet to the vet for an illness, but when you do it’s comforting to see how effortless and easy filing a claim wuth spot can be. Will remember to tell my friends and neighbors how good it is to deal with this company.

Efficient

My claim was taken care of in a timely manner. The online questions were easy to answer and submit.