PetsBest Pet Insurance Plans Vs. Spot Pet Insurance Plans Comparison

Find the perfect pet insurance for you with our helpful guide to the differences between Spot Pet Insurance plans and Pets Best Insurance plans. At Spot, we're happy to compare ourselves to others because we're confident in the products we offer. Let’s take a look at what you get with a Spot Pet Insurance plan vs. a PetsBest Pet Insurance plan.

Comparing Pet Insurance Plans

Caring for the health of our pets is a central responsibility for all pet owners, from routine care considerations like vaccinations and heartworm medication to more specialty care options like microchipping and acupuncture. Exam fees can really start to add up, whether you’re dealing with preventative care or emergency care. But are pet insurance plans the best way to go forward?

Although research supports the benefits of pet insurance, choosing what’s ideal for you becomes difficult as you find dozens of potential pet insurance providers.

Questions about deductibles, reimbursement levels, waiting periods, claims processing and other factors are common and crucial. The answers vary widely based on your situation and the plans available. Sometimes a bit of help is needed to find what truly sets a pet insurance plan apart without spending hours researching.

At Spot Pet Insurance, our passion for the wellness of pets is core to everything we do. From exceptional customer service and informative resources to concise insurance comparisons, we are here to help.

Today, we’re lending a hand in your search for the right pet insurance provider for you. Read on to see some of the ways Spot Pet Insurance plans and Pets Best Insurance plans differ in areas that can help you make the best decision.

Behavioral Issues

No Upper Age Limit

Exam Fees

Preventive Care

Microchip

Prescription Foods

Alternative Therapies

Chronic Conditions

One Annual Deductible

Specialists

Hereditary & Congenital Conditions

Dental Illness

Multi Pet Discount

30-Day Money Back Guarantee

Comparison information is provided using publicly available information as of 3/2/24 and is only meant to summarize program features, not a specific plan. Review each provider’s plan terms for more details. The descriptions of other providers’ plans were not provided by that company. If you have questions about other plans, please contact an agent of that company. It is our intention to provide fair and accurate comparison information. Although we attempt to keep information up to date, it may change from time to time. If you are aware of any inaccuracies or changes in the information provided, let us know by emailing marketing@spotpet.com.

Spot Pet Insurance plans’ Multi-Pet Discounts vs. Pets Best plans’

If you’re a parent to multiple dogs or cats, you can enjoy a 10 percent multi-pet discount with Spot Pet Insurance plans for all additional pets.

PetsBest pet insurance plans also offer a multi-pet discount but for five percent off and exclusively with the BestBenefit plan.

Spot Pet Insurance plans include coverage for Rx food & supplements prescribed to treat covered conditions

We know that pet health often extends beyond vet visits, and so do the costs. With pet insurance plans provided by Spot, core plans include coverage for RX food & supplements when prescribed by a licensed veterinarian to treat covered conditions (excluding general maintenance or weight management).

With PetsBest plans, Rx foods and supplements are excluded from pet insurance coverage.

Spot Pet Insurance Plans provide access to a 24/7 pet telehealth service powered by VetAccess™. At Spot Pet Insurance, we’re proud to partner with VetAccess™ to bring policyholders' pet telehealth services available 24/7, immediately upon enrollment. VetAccess™ provides pet telehealth service.

Having help always available is key, as you never know when you may need it. We’re glad to offer plans that provide access to a pet telehealth service for all policyholders.

Pet Parent Education Thrives at Spot Pet Insurance

When protecting your pet’s health, knowing is half the battle.

At Spot Pet Insurance, we’re excited to share an extensive library of lifelong learning resources, including exclusive materials from world-renowned pet experts. From breed guides to frequently asked questions, we offer a variety of core pet parent knowledge. Wondering whether fresh food is worth it for dogs, for example? We’re here to help you find out.

Combined with our highly customizable plan options, you can be sure that we’re here to help you find the best way forward for your furry family members.

Conclusion

Finding the perfect pet insurance policy for your pet family is easier than you might think through insurance comparisons like this. Get a quote today to see if joining the Spot family is right for you, and keep coming back to our blog for more helpful guides like this!

Tucker's Road to Recovery

When emotional support dog Tucker experienced a life-threatening injury to his neck, he needed extensive treatment. His pet parent Kim was able to choose the treatment option that would provide Tucker with the best quality of life because of the financial support provided by Tucker's Spot plan.

Cost of Treatment: $4,305

Spot Plan Reimbursed: $3,874.505

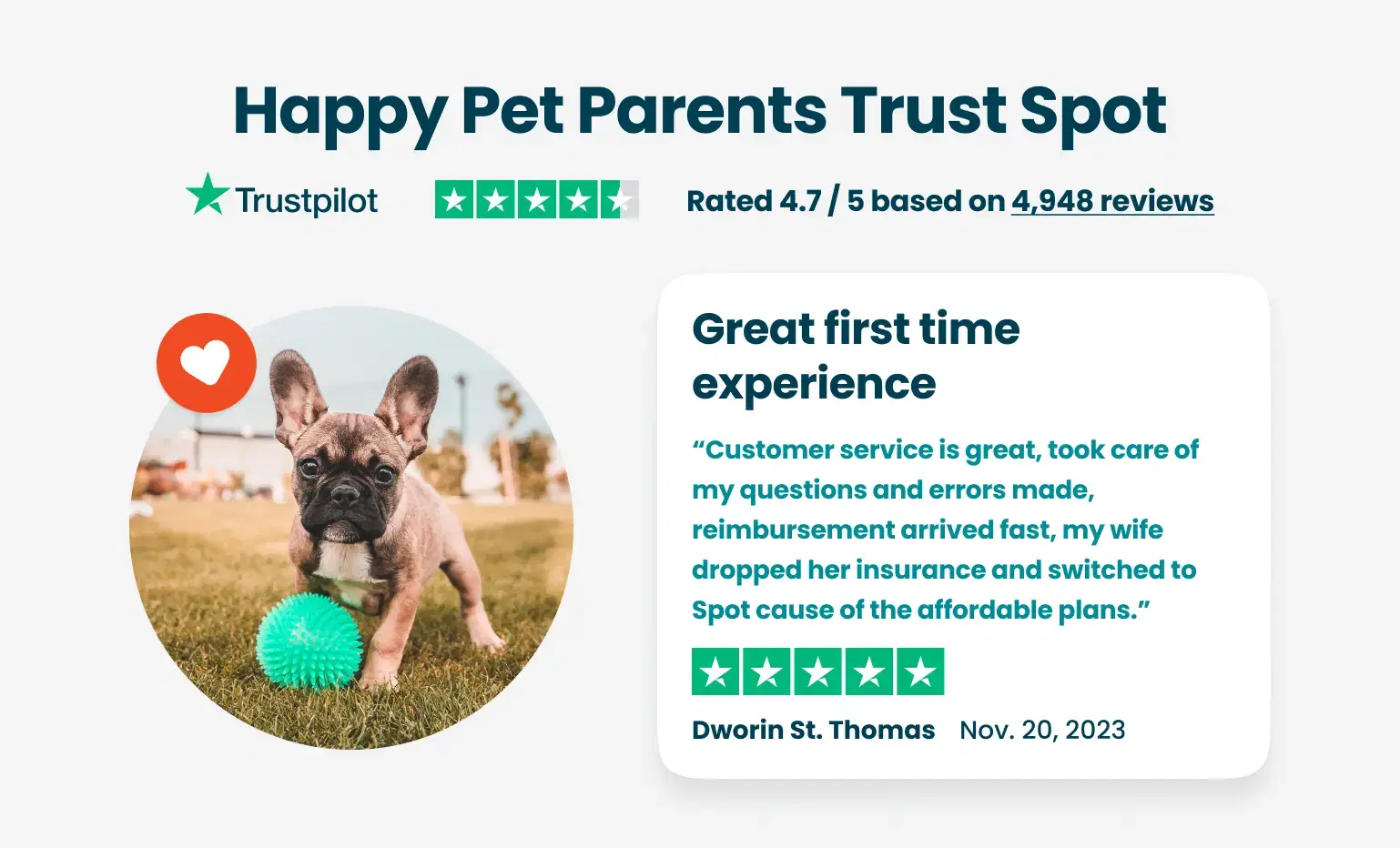

Happy Pet Parents Trust Spot

Extremely Pleased

My dog had crypt orchid for which he had an orchiectomy and was neutered. I submitted a claim which was denied for having been a preexisting condition. In 2025 my dog was attacked by a much bigger dog. He had an overnight stay at a Pet Emergency Hospital including surgery and several fu visits I was pleasantly surprised that Spot reimbursed me 90% of all of these vet bills which was thousands of dollars! In early 2026 my dog got treated for ear infection and this treatment was also covered at 90% after my $100 deductible was met I am extremely pleased with this Pet Insurance submitting a claim is streamlined and the response time prompt! Thank you SPOT

Our First Claim…Easy and quick!

Our dog developed severe dental disease requiring numerous extractions and bone loss from an abscessed tooth. I was very happy about how easy it was to send in the bill from the vet and payment was issued in less than a week. Spot processed the claim in a fair manner and we did not have any difficulties. This was our first claim in almost three years of coverage so I wasn’t sure what to expect but am happy to say Spot provided the coverage we paid for and makes it very easy to submit your claim! Highly recommend them.

Efficient

The process was quite simple and non-bureaucratic. The claims were processed quickly, statuses were communicated, and there was no back-and-forth with disputes, needs for endless documentation and verification, or any other red tape.

Efficient on time claim resolution

Efficient on time claim resolution

How fast you were to process my claims

How fast you were to process my claims

Easy payment reimbursement

Easy to navigate claims

Quick

Quick, no questions asked/no hassle reimbursements. For sure helps with an already stressful situation. I’ll recommend them to anyone

Spot was there when it mattered most.

In one of the most difficult times in my life as a dog mom, Spot seemlessly managed the bills I submitted. I didn't need to jump through hoops as I have with other insurance companies. Instead, I was able to simply submit my bills and the payment came quickly and without issues. It made an extremely difficult time, less stressful knowing Spot was there to help.

You have been fair and upfront with…

You have been fair and upfront with payments. Thank you, I feel that I have chosen the right pet insurance

Such Great company and Insurance for…

Such Great company and Insurance for our doggy Rocky paid great for his Knee surgery after his injury:)