Prudent Pet Insurance Plans Vs. Spot Pet Insurance Plans Comparison

See how Prudent Pet Insurance plans and Spot Pet Insurance plans differ in today’s comparison. Doing your homework before you enroll your pet will help ensure you’ve picked a good pet insurance plan for your furry family member. At Spot, we're happy to compare ourselves to others because we're confident in the products we offer. Let’s take a look at what you get with a Spot Pet Insurance plan vs. a Prudent Pet Insurance plan.

One web search for pet insurance will show you an array of options to choose from. You know you need to get your pet the proper vaccines and that you need to be prepared in case of emergency hospitalization for something like a ligament injury, but you might not be as sure about pet health insurance. Figuring out how to handle your pet’s needs can get tricky.

Between dozens of pet insurance providers and widely varying pet insurance policies, narrowing down the right pet insurance plan can feel overwhelming.

Although quotes are a great place to start, at Spot Pet Insurance, we go the extra mile with helpful comparison guides between our insurance and other pet insurance providers, such as Nationwide or Pets Best.

Today’s guide breaks down the most critical differences between Spot Pet Insurance plans and Prudent Pet Insurance plans. Read on to see where we differ and to get closer to finding the ultimate pet insurance fit for you!

Behavioral Issues

No Upper Age Limit

Exam Fees

Preventive Care

Microchip

Prescription Foods

Alternative Therapies

Chronic Conditions

One Annual Deductible

Specialists

Hereditary & Congenital Conditions

Dental Illness

Multi Pet Discount

30-Day Money Back Guarantee

Comparison information is provided using publicly available information as of 3/2/24 and is only meant to summarize program features, not a specific plan. Review each provider’s plan terms for more details. The descriptions of other providers’ plans were not provided by that company. If you have questions about other plans, please contact an agent of that company. It is our intention to provide fair and accurate comparison information. Although we attempt to keep information up to date, it may change from time to time. If you are aware of any inaccuracies or changes in the information provided, let us know by emailing marketing@spotpet.com.

Wellness Plan Differences: Spot Pet Plans vs. Prudent Plans

Wellness care for your pets is essential, but whether or not to include certain parts of wellness care in your insurance plan is another matter that can differ for each pet family.

Spot Pet Insurance and Prudent Pet Insurance both offer add-on wellness coverage options that can supplement a core Accident & Illness plan or an Accident-only plan for an additional cost. However, there are some key differences.

Base plans provided by Spot include coverage for microchip implantation. In order to get coverage for microchip implantation with Prudent Pet Insurance plans, you need to add on a wellness plan to your base plan for an additional cost.

Microchipping is a helpful way to find your pet should they become lost.

With the Gold Preventive Care Coverage add-on option offered by Spot, you are covered for up to $100 for dental cleanings annually, or $150 for dental cleanings annually with the Platinum Preventive Care Coverage option. See our preventive care coverage plan breakdowns for more details!

At Prudent, on the other hand, three levels of wellness coverage add-on options are available – low, medium, and high – and include $0, $40, and $60 of coverage, respectively, for dental cleanings annually. Prudent also requires pets to have routine dental exams to qualify receive reimbursement for dental illnesses.

Exam Fees For Covered Conditions Are Included in Base plans provided by Spot

At Spot Pet Insurance, the base plans we provide include coverage for exam fees for covered conditions.

In contrast, with Prudent Pet Insurance plans, you’ll have to purchase an additional add-on to get coverage for exam fees for covered conditions.

Prescription Food Coverage

Spot Pet Insurance plans include coverage for Rx food and supplements when they’re prescribed by a licensed vet to treat covered accidents and illnesses (not for general maintenance or weight management).

Prudent plans only cover Rx food when it is prescribed to treat existing bladder stones and crystals in urine.

Conclusion

We want you to find the perfect fit for your fur family’s best interests. From helping you stay educated to providing extensive pet insurance plans, we’re here to help. Whether you’re trying to learn more about your pup’s hereditary condition, you’re curious about prescription medication for your cat, or your pet swallowed something they shouldn’t have, we want to help give pet owners the support they need.

Get a quote today to see if joining the Spot family is right for you, and keep coming back to our blog for more helpful guides just like this one!

Tucker's Road to Recovery

When emotional support dog Tucker experienced a life-threatening injury to his neck, he needed extensive treatment. His pet parent Kim was able to choose the treatment option that would provide Tucker with the best quality of life because of the financial support provided by Tucker's Spot plan.

Cost of Treatment: $4,305

Spot Plan Reimbursed: $3,874.505

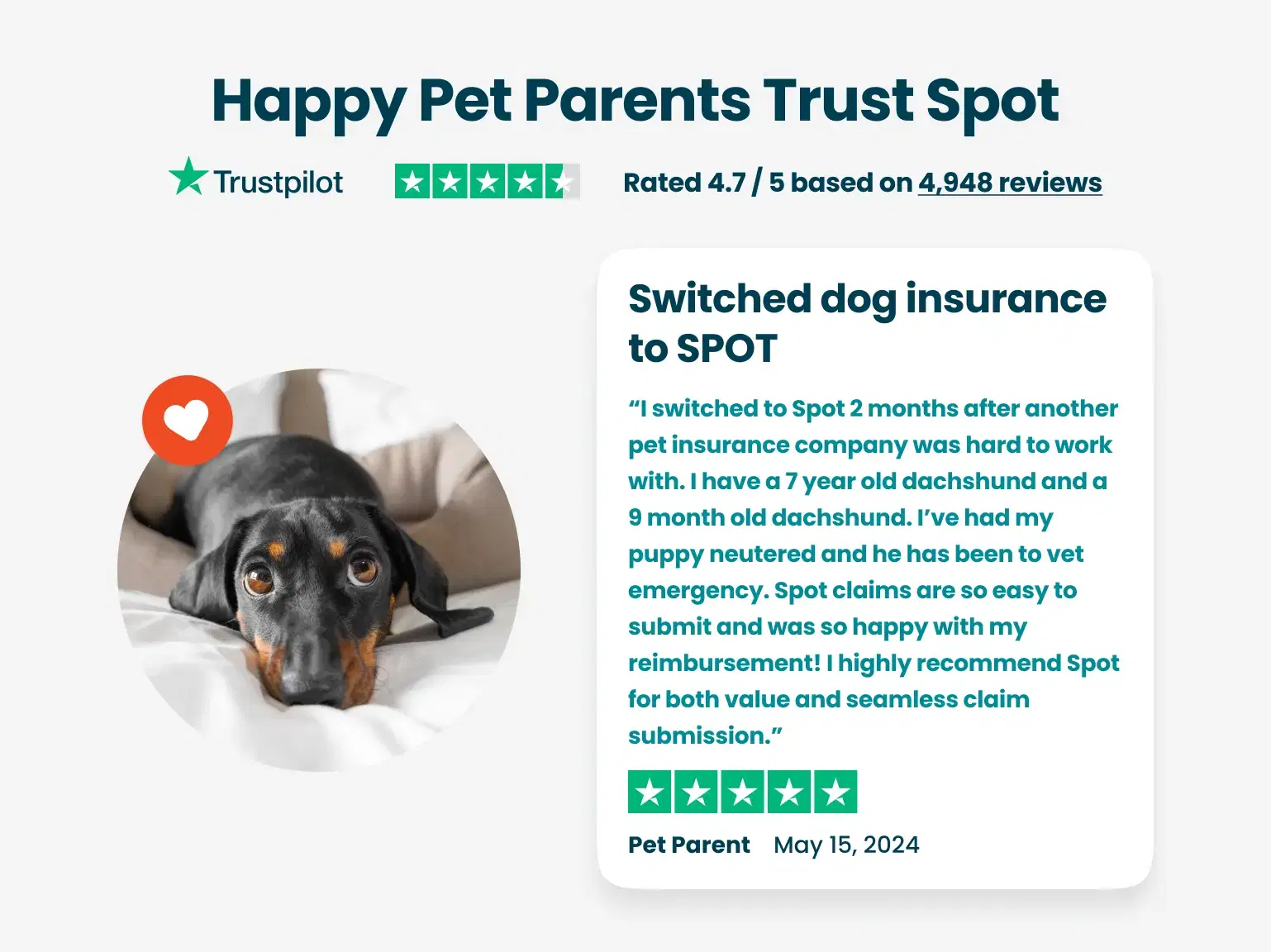

Happy Pet Parents Trust Spot

Filing a claim with Spot is so easy

Filing a claim with Spot is so easy. My claim was reviewed quickly and the direct deposit processed fast too. Having Spot Pet Insurance lessens the anxiety of having to take my pets to the vet. When my cat had to go to the emergency vet, at least I didn’t have to worry about how I was going to cover the cost.

This is my first claim

This is my first experience with pet insurance. First claim. It was super easy. Got the check in the mail today. Very pleased.

Great return for the cost

Great return for the cost! Easy to use claim process!

Good communication

Good communication, quickly claims processing.

Easy filling and quick refunds

Easy filling and quick refunds

Handled our claim in a prompt…

Handled our claim in a prompt professional manner.

Got Spot for my Doggie 4 years ago at…

Got Spot for my Doggie 4 years ago at the ripe age of 3 months. 3 weeks ago she tore her ACL and had surgery. Made a claim at Spot and the claim was handled and processed in record time and received my reimbursement just yesterday. Unbelievable

Quick and easy

Quick and easy. Helps offset the vet bills never had any issues.

Great rates

Great rates. Super quick claims service. Buy it!

Very quick claim response

Very quick claim response. Professional service.Glad we chose spot for our pups insurance!